Airline miles are a valuable asset. They can unlock free travel, seat upgrades, or even full international flights in business class. But what many people don’t realize is that miles can expire, be forfeited, or devalue over time if not managed carefully. If you’ve spent months or years building up a mileage balance through travel, credit cards, and promotions, the last thing you want is to see it vanish.

In this article, you’ll learn how to prevent your airline miles from expiring, how to track and manage your accounts across different programs, and the smart behaviors that ensure your miles work for you, not against you. Whether you live in Brazil, Europe, or the United States, these strategies will help you keep your rewards secure until you’re ready to use them.

Why Airline Miles Expire

Not all airline programs operate the same way. Some have strict expiration dates, while others use activity-based expiration policies. Understanding the rules of the programs you participate in is the first step to keeping your miles safe.

In Brazil, most programs like Smiles, TudoAzul, and Latam Pass set a fixed expiration period—typically between 2 to 3 years from the date the miles were earned. In Europe and the United States, many programs have shifted to activity-based policies. This means your miles stay valid as long as your account remains active, usually through earning, redeeming, or transferring miles within a set period (commonly 18 to 24 months).

For example, AAdvantage miles (American Airlines) remain valid if there is activity on the account every 24 months. Flying Blue miles expire after 24 months unless you earn miles through a flight or hold elite status. United MileagePlus, on the other hand, removed expiration dates altogether—a major advantage for travelers who don’t fly regularly.

Track Your Accounts and Set Reminders

One of the main reasons travelers lose miles is simply forgetting about them. When you’re a member of multiple programs across different countries, it’s easy to lose track of expiration dates, balances, and activity requirements.

Use free tools like AwardWallet or Point.Me to monitor your frequent flyer accounts. These services consolidate all your balances into one dashboard and notify you when your miles are about to expire. Alternatively, a simple spreadsheet can help if you prefer manual tracking. Include the program name, current balance, date of last activity, and expiration date.

Don’t rely on airlines to send you reminders. Many programs don’t actively alert you when miles are nearing expiration. Proactive tracking is your best defense.

Perform Small Activities to Keep Miles Active

In many programs, even small account activity resets the expiration clock. You don’t need to book a flight—just earning or redeeming a small number of miles may be enough.

Some easy ways to trigger account activity include:

- Shopping through airline e-commerce portals

- Transferring credit card points (e.g., Livelo, Amex, Esfera)

- Booking a hotel stay with a partner

- Renting a car and earning miles

- Donating a small number of miles to charity

- Redeeming miles for a low-cost magazine subscription or upgrade

For example, transferring 1,000 points from Livelo to Smiles can reset the validity of your entire balance. In Europe, buying something through Flying Blue’s online store—even for just a few euros—can keep your miles active.

These small actions are useful when you’re not planning to travel but still want to protect your miles from disappearing.

Consider Joining Loyalty Clubs

In Brazil, many frequent flyer programs offer paid loyalty clubs that give members extended expiration timelines or even eliminate expiration for as long as you’re a member.

Clube Smiles, Clube TudoAzul, and Latam Pass Clube all offer monthly mile deposits, early access to promotions, and extended mileage validity. In some plans, the miles you receive while subscribed never expire. For people who earn miles primarily through credit card transfers or shopping, club membership can be an efficient safeguard.

In the U.S. and Europe, elite status or premium co-branded credit cards may offer similar protections. For example, having a Flying Blue Gold card or American Airlines Platinum status often gives you longer expiration periods or waives expiration entirely.

While there’s a monthly fee to consider, the benefits of protecting a large mileage balance often outweigh the cost—especially if you travel internationally or save miles for premium redemptions.

Protect Your Miles From Devaluation

Miles not only expire—they can lose value over time. Airlines occasionally update their award charts or switch to dynamic pricing models that make flights more expensive in miles. This is known as “mileage inflation.”

To reduce the impact of devaluation:

- Avoid hoarding miles for too long

- Redeem miles regularly, even for short trips

- Monitor upcoming changes to award charts and book in advance

- Subscribe to airline newsletters to catch promotions before pricing changes

- Store points in flexible programs (Livelo, Amex, Membership Rewards) until needed

By staying active and aware, you avoid waking up to find your 100,000 miles now only cover half of what they used to.

Secure Your Account Against Fraud

Airline miles are a digital currency, and like any financial asset, they can be stolen if your account is not properly secured. Identity theft and account hacking have affected major airline programs in recent years.

To protect your miles:

- Use strong, unique passwords for each loyalty account

- Enable two-factor authentication where available

- Don’t share your account details with others

- Check account activity periodically for unauthorized transactions

- Avoid accessing loyalty accounts on public or unsecured Wi-Fi networks

If you notice suspicious activity, contact the airline immediately. Most programs have a security team and may be able to recover stolen miles if reported quickly.

Don’t Wait Too Long to Redeem

It’s tempting to save your miles for a dream trip or a rare opportunity, but holding onto them too long increases the risk of expiration, devaluation, or unexpected program changes. Miles are meant to be used.

Try setting redemption goals every year. Even if it’s a short-haul domestic flight or a cabin upgrade, redeeming regularly keeps your account active and prevents surprise losses. It also allows you to enjoy the rewards of your spending and loyalty instead of watching your balance vanish due to inaction.

If you’re planning a big international trip, monitor availability and pricing trends several months in advance. This way, you can redeem when the value is optimal and ensure your miles go toward something meaningful.

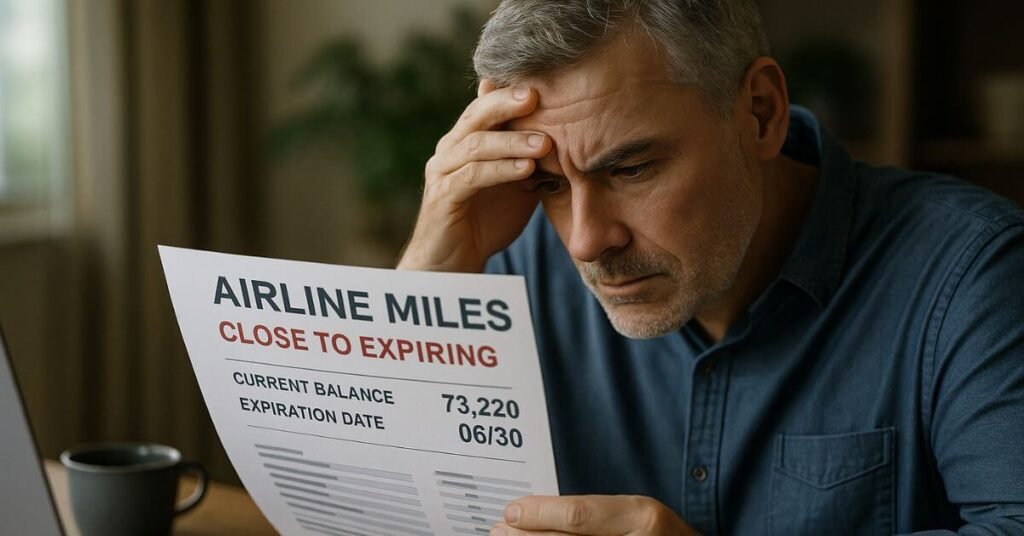

What to Do If Your Miles Are About to Expire

If you discover that your miles are close to expiring, don’t panic. Many programs offer last-minute options to protect or extend your balance.

In Brazil, Smiles and Latam Pass sometimes allow you to extend the life of expiring miles by paying a fee or moving them to a different account tier. In Europe and the U.S., you might be able to extend validity by redeeming a small portion of miles, buying miles, or completing a partner transaction.

Reach out to customer service if needed. Some programs have special policies for elite members or cardholders, and they might help you preserve your balance.

Even if some miles are lost, staying informed and improving your tracking will prevent the issue from repeating.

Your Miles Deserve to Be Used, Not Forgotten

Airline miles are a powerful currency that can take you across continents, upgrade your flights, or bring family closer together. But if you don’t manage them properly, you risk losing out on years of effort and opportunity.

By staying aware of expiration rules, tracking your accounts, triggering regular activity, and using your miles consistently, you’ll ensure that every mile you earn works in your favor.

Make your miles part of your travel strategy—not a forgotten number in a loyalty account. Use them, share them, protect them, and enjoy the benefits they were meant to deliver.

Elaine A. da Silva is a Brazilian travel and finance enthusiast, best known as the creator of the blog Dica das Milhas. With a strong background in personal finance and a passion for exploring smart travel strategies, she specializes in simplifying the world of airline miles and travel rewards for everyday people. Through her blog, Elaine shares practical tips, insider knowledge, and step-by-step guides to help readers save money and travel more efficiently using loyalty programs and credit card points.